Rosa Wyse

Manager/Broker

at Champion Real Estate

Access is made available only to those who accept the terms of the following agreement. By accepting this agreement, I certify the following: I am at least 18 years of age. All content and information published on RosaWyseTruth.com website is supported by facts and witness accounts. The content on RosaWyseTruth.com website is for general information purposes only. By logging on, I will have released and discharged the providers, owners and creators of this site from any and all liability which might arise. Bookmarking to a page on this server / site whereby this warning page is bypassed shall constitute an implicit acceptance of the foregoing terms herein set forth.

May 2022: We hired Rosa Wyse as our Real Estate agent to help purchase a house and asked to recommend us a Mortgage Lender.

Mrs. Wyse personally vouched for Loan Officer William B. Murphy and Fairway Mortgage Bank. Mrs. Wyse told us: "Bill is a professional and honest man. I know him for over 20 years. He will take care of you. Bill will get you a great loan!"

Rosa Wyse confirmed in our lawsuit:

But William B. Murphy and Fairway compiled a fraudulent loan application and trapped us in a Predatory Mortgage Loan. For details, visit our website: The Mortgage Fraud

Zillow Estimated Market Value (Zestimate) is "Zillow's estimated market value for a home, computed using a proprietary formula including public and user-submitted data, such as details about a home (bedrooms, bathrooms, home age, etc.), location, property tax assessment information and sales histories of the subject home as well as other homes that have recently sold in the area." (Source)

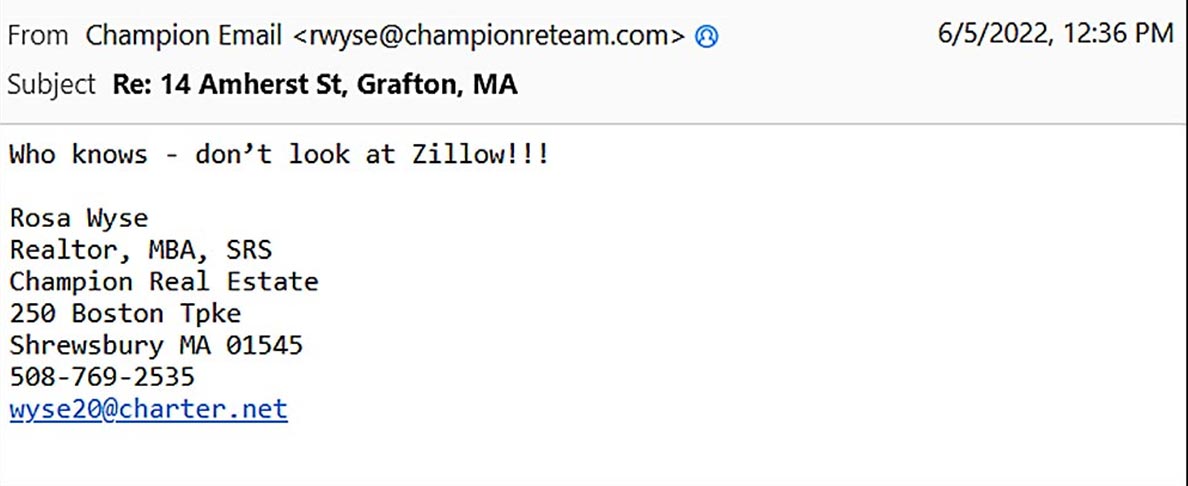

June 5, 2022: We asked Rosa Wyse how Zillow calculates estimated market value. Mrs. Wyse responded: "Who knows – don't look at Zillow!!!"

We reviewed 16 properties we visited in May / June 2022 with Rosa Wyse to compare how Zillow predicted the property market value (sold price):

Rosa Wyse said: "This is a very hot market. If Sellers have two matching offers and one of them waives inspection, they will go with that one."

We were concerned about purchasing a vintage house (1930's – 1950's) without any inspection. Rosa Wyse yelled at us: "Do you want to buy a house? Or do you want to spend months looking and not buy anything?"

June 5, 2022: We liked the 1952 house located on Amherst St, North Grafton, MA listed for $339,000. Zillow Estimated Market Value: $386,100. Rosa Wyse recommended that we offer $395,000 and waive inspection. Seller immediately accepted the offer. But we withdrew the offer because Seller demanded that we waive inspection on this vintage house. The property sold for $380,000 (7/13/2022). Zillow over-estimated Market Value by 1.61% ($6,100).

June 6, 2022: We liked 1967 house located at Brigham Hill Rd, North Grafton, MA. Listed Price: $349,000. Zillow Estimated Value: $400,000. Rosa Wyse recommended that we offer $401,000 to Seller and waive inspection. But Sellers rejected our offer. Nearly three months later, the property sold for $365,000 (8/25/2022). Zillow over-estimated market value by 9.59% ($35,000).

June 13, 2022: We decided to bid on the final property in Worcester, MA listed for $289,000. Zillow Estimated Market Value: $308,000. We asked Rosa Wyse how much we should offer. Mrs. Wyse responded: "I was thinking of presenting an offer of 350k and doing an escalation up to 370k." We trusted Mrs. Wyse's expertise and offered $350,000.

Based on our statistical analysis, Zillow over-estimated the property values by 5.45% and under-estimated the property values by 2.88% (on average).

Using this range on $308,000 Zillow Estimated Property Value:

Based on Rosa Wyse's aggressive sales tactics, we estimate we overpaid $33,130 - $58,786 on the house.

Appraisal Gap "happens when the house appraises for less than your offer. You can pay the difference or renegotiate." (Source)

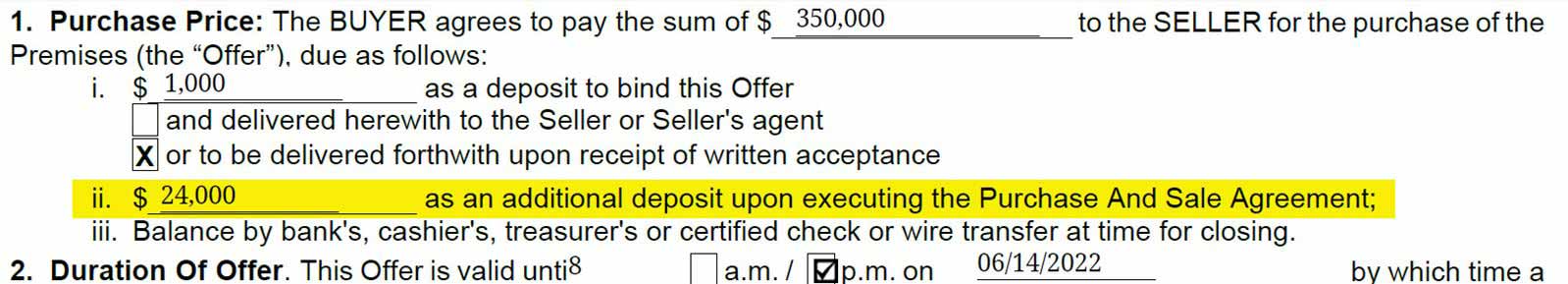

June 13, 2022: Rosa Wyse inserted secret $24,000 "additional deposit" into the offer but did not explain it to us. Then Mrs. Wyse demanded that we pay additional $24,000 cash to Sellers for the "Appraisal Gap." We categorically refused to pay this unauthorized amount.

June 23, 2022: After we refused to pay $24,000 for the "Appraisal Gap", Rosa Wyse now demanded we pay $15,000 instead of $24,000. Mrs. Wyse did not specify "Appraisal Gap" clause in our "Contract to Purchase Real Estate."

Rosa Wyse wrote: "I spoke to the list agent ... they are confirming the appraisal gap coverage of the $15k just in case. We should be all set but wanted to run it by you."

We categorically refused to pay $15,000 Appraisal Gap.

Rosa Wyse and William B. Murphy hired an appraiser by themselves and sent us the bill. We have never heard about this appraiser company. In the end, Appraisal was approved without requiring us to pay any Appraisal Gap.

Appraisal Fraud "involves intentionally misstating the value of a home. This often happens when licensed appraisers purposely understate or over-inflate a home's worth. For example, an appraiser may be pressured by a lender to inflate a home's value so the buyer's lender can earn more in fees from a home sale." (Source)

After several visits, we were not comfortable with Rosa Wyse's aggressive and high-pressure sales tactics. A few times Mrs. Wyse yelled at us for refusing to proceed with offers we were not comfortable with. She demanded we bid a high amount without any inspection on vintage houses.

Rosa Wyse constantly vilified Zillow "Estimated Market Value" as "total garbage." She wrote: "Don't look at Zillow!!!"

Now we realize that Zillow undermined Rosa Wyse's goal to over-inflate the property value and convince us to offer an astronomical amount. This would financially benefit her with higher commission and larger profits for the Sellers & their Real Estate Agent.

Rosa Wyse did not defend our interests. Two times, we contemplated firing Rosa Wyse and replacing her with another Real Estate agent. But we feared Mrs. Wyse would retaliate against us and sabotage our "pre-approved financing" with her friend and business associate William B. Murphy.

We were under great pressure to purchase the Worcester house and sign William B. Murphy's Predatory Mortgage Loan. In one of several contentious phone calls, we told Rosa Wyse we were considering canceling the transaction because there was a large difference between the purchase price and Zillow Estimated Value.

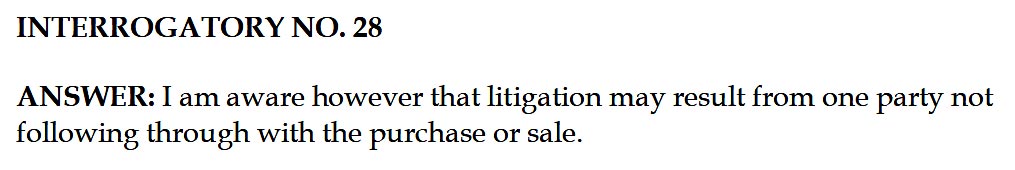

Rosa Wyse threatened that Seller may sue us for backing out of a sale. On 11/20/2023, Mrs. Wyse confirmed in our lawsuit that litigation is possible when one party does not follow through with the purchase sale:

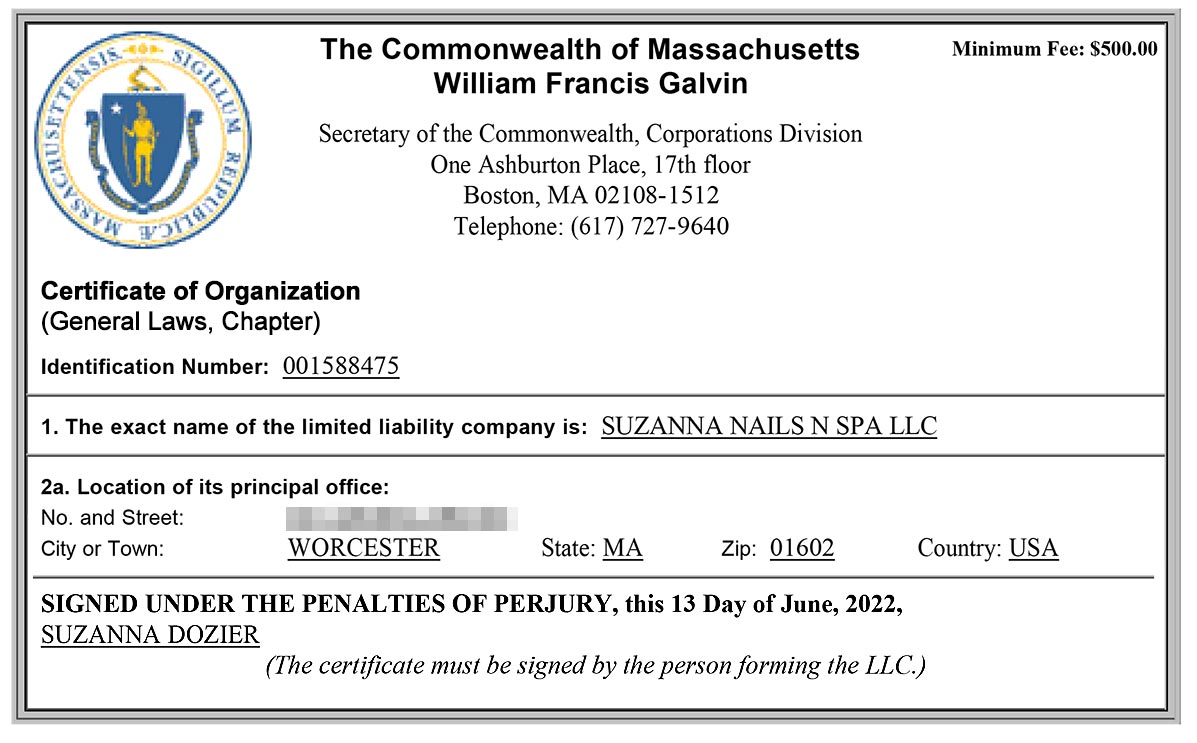

June 13, 2022: (2 days after Seller's Open House) an unknown person Suzanna Dozier registered fraudulent SUZANNA NAILS N SPA LLC at our future home. Massachusetts Secretary of State Office told us they cannot dissolve the fraudulent LLC without a Court Order.

Jean-Marie Minton

Seller's Agent/Broker

We asked Rosa Wyse and Seller's Agent Jean-Marie Minton multiple times to resolve this issue. Ms. Minton refused to respond to our several letters. Rosa Wyse emailed a few local officials but the response was the same: Nothing can be done without a Court Order.

Rosa Wyse told us that Attorney Jessica Albino is responsible for resolving this issue. 21 days prior to Closing Day, Attorney Albino was assigned to us by Mr. Murphy. We have never met Mrs. Albino before.

Attorney Jessica Albino did not explain all documents we were required to sign. When we asked Attorney Albino to delete the fraudulent LLC registered to our new home, she demanded we pay her additional money.

In the end, Rosa Wyse, Attorney Jessica Albino and Jean Marie Minton refused to resolve the issue with a fraudulent LLC registered to our home.

We hired Rosa Wyse as our real estate agent to purchase our home. We trusted her completely.

Rosa Wyse used high-pressure sales tactics to convince us to purchase the home at over-inflated price and sign her friend William B. Murphy's Predatory Mortgage Loan.

Mr. Murphy compiled a fraudulent mortgage loan application and entrapped us in a Predatory Mortgage Loan that was "doomed to fail" from Day One.

30 months later, our "Excellent" credit scores have been destroyed. Now we face the risk of losing our family home to a wrongful foreclosure sale, becoming homeless and financially ruined.

We are currently suing Mr. Murphy, Fairway Mortgage and Rosa Wyse to prevent wrongful foreclosure of our house. For details, visit our website: The Mortgage Fraud